puerto rico tax incentive act

Act 22 - The Individual Investors Act now included under Act 60 of PR Tax Incentive Code of July 2019 Act 22 as amended also known as The Individual Investors. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS.

Big Changes Coming For Puerto Rico S Act 20 Tax Incentive Program Premier Offshore Company Services

0 to 1 tax rate on income for pioneer or novelty products manufactured in Puerto Rico.

. On March 4 2011 Puerto Rico enacted Act No. Many high-net worth Taxpayers are understandably upset about the massive US. 1 Fixed Income Tax Rate for pioneer or novel product manufacture.

Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act. Individual Eligibility for Puerto Rico Tax Incentives. Taxes levied on their.

Act 20 was renamed the Puerto Rico Export Services Tax Incentive and became Chapter 3 of Act 60 while Act 22 was now called the Puerto Rico Investor Resident Individual. Neither PRelocate LLC nor any of its. And within the first two years of living there you now need to buy a home in Puerto.

Puerto Rico US Tax. Puerto Rico Tax Incentives Act 60. 4 income tax on industrial development income.

4 Fixed income tax rate on development preproduction production and post-production income. Puerto Rico Incentives Code 60 for prior Acts 2020. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

Incentives Code Changes to Act 20 Act 22. 4 Fixed Income Tax Rate on Income related to export of services or goods. The Act provides the following benefits.

To qualify for tax incentives an individual taxpayer must be a bona fide resident of Puerto Rico for an entire tax year. The Torres CPA Group works diligently to ensure you understand all of the laws regarding your Puerto Rico. Puerto Rico Tax Act 22.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. The mandatory annual donation to Puerto Rican charity increased from 5000 to 10000. View the benefits of allowing us to manage your Puerto Rican tax incentives.

0 US Federal Income Tax. With the goal of promoting economic development in Puerto. Make Puerto Rico Your New Home.

Act 60 2019 - Puerto Rico Tax Incentive Act 60 was created in 2019 to establish the new Puerto Rico Incentives Code. Act 20 Puerto Rico Tax Incentives. 100 Tax Exemption on Income Tax Rate.

27 of 2011 as amended known as the Puerto Rico Film Industry Economic Incentives Act the Act to solidify its position as one of the.

Enjoy Lower Taxes With Puerto Rico S Act 60 Tax Incentives Relocate To Puerto Rico With Act 60 20 22

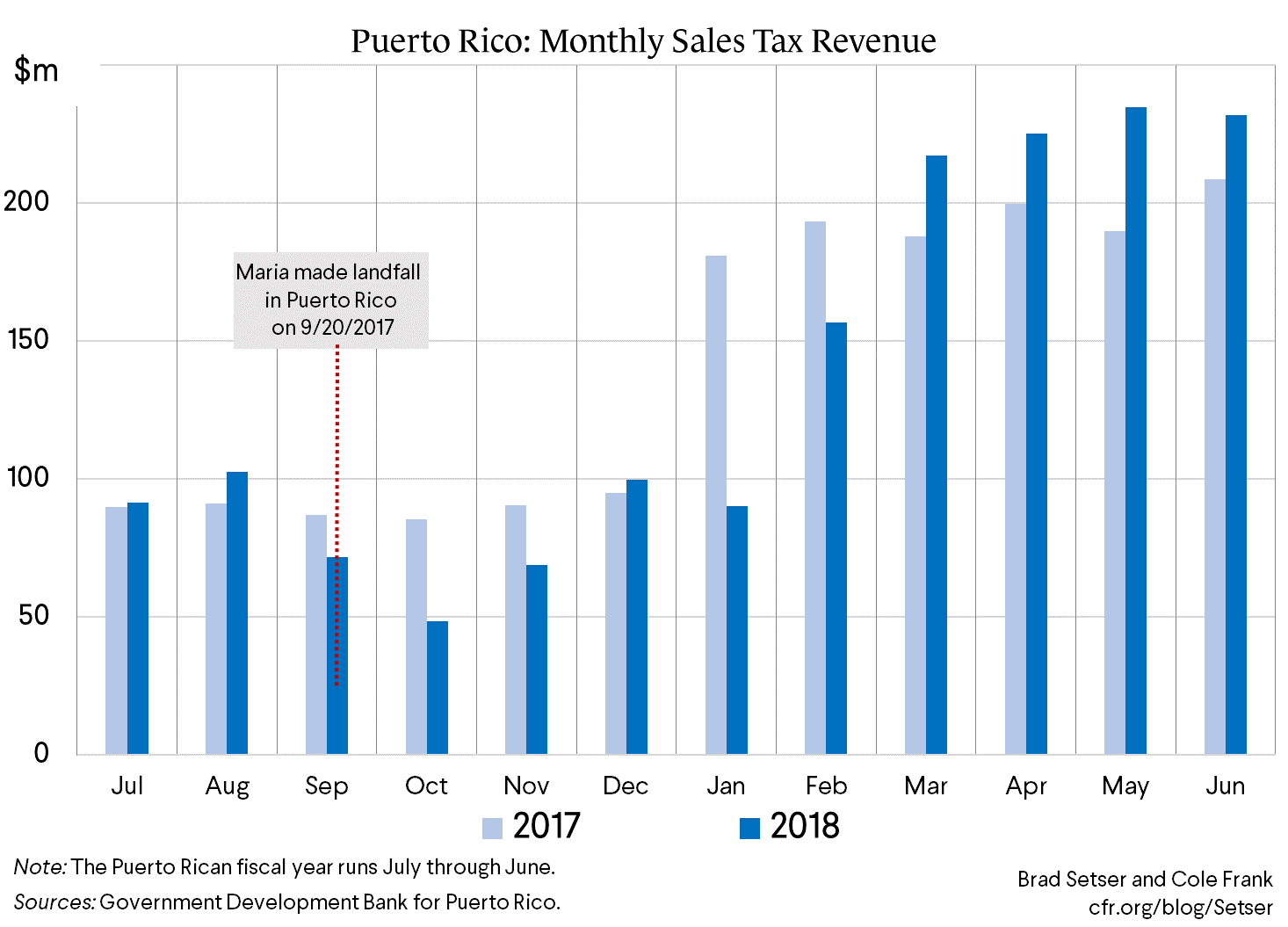

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Puerto Rico Tax Incentives The Ultimate Guide To Act 60

The Downside Of Puerto Rico S Insanely Great Tax Incentives Sovereign Research

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Tax Incentives In Puerto Rico Tax Act 60 Tax Act 20 22 Living In Puerto Rico Youtube

Puerto Rico Tax Incentives Defending Act 60 Youtube

Puerto Rican Tax Incentives With International Tax Professional Peter Palsen Youtube

Puerto Rico Tax Incentives Pellot Gonzalez

Puerto Rico Tax Incentives Act 20 22

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

A Red Card For Puerto Rico Tax Incentives

Puerto Rico S Allure As A Tax Haven

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Relocate To Puerto Rico With Act 60 20 22

Tax Benefits Puerto Rico S Strategic Location Status As A Us Jurisdiction And Generous Tax Incentives Make It An Ideal Base For Entities That Provide Ppt Download

How Entrepreneurs Can Save On Taxes In Puerto Rico

Petition Eliminate Puerto Rico S Act 60 20 22 Change Org

Act 60 Puerto Rico Science Technology Research Trust

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time