best companies to sell covered calls

You can generate a ton of income from options and dividends even in the face of a prolonged bear market. The Best Covered Call Stock.

/close-up-of-stock-market-data-on-digital-display-1058454392-9e48e65462e14a04a74008cbe0ec9aa9.jpg)

Covered Calls Basics Risks Advantages Overview

A Covered Call or buy-write strategy is used to increase returns on long positions by selling call options in an underlying security you own.

. Loss is limited to the the purchase price of the underlying. That means you spent a total of 1000 x 20 20000. Covered Call Option Trade.

Best Stocks for Covered Calls For example Consolidated Edison ED. Covered call writing is not like directional trading in which the goal is to time the movement of a stock. XOM EXXON MOBIL.

It wouldnt make sense for them to dump a company theyve owned for perhaps decades and. That includes monthlies of all durations including LEAPs. Walmarts stock price never closed below triple digits and demonstrated good support ahead of the psychological 100 level that can help protect a covered call position from losses.

There is a bit of a. If OHI closes below 39 that day well still own our shares. The Best Covered Call Stock.

These are two dividend stock examples that are some of the best stocks to write covered calls against. Weeklys are at least 2x more popular now. The covered writers goal is to get in and out of the stock and pocket the premium income stream without damage.

January 45 - hitting volume resistance. We researched it for you. These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience.

You purchase 1000 shares of XYZ Corp. And we can then write a. Selling covered calls is a guaranteed way to earn weekly monthly income and yes it can be very profitable.

Lets look at the following steps. First and foremost you need to do your own research and pick a company that you like enough to want to hold their stock. Both online and at these events stock options are consistently a topic of interest.

The next step is to pick the price target you want for the trade. On the open market for 20 per share. But whenever youre convinced that a stock will be moving higher from that point on would be the best time to write covered calls out of the money.

Exercise will result in delivery of cash on the business day following expiration. Its more capital efficient to buy LEAPS and sell calendars on them. Ad The Best Alternatives to Covered Calls.

There are many factors in choosing a stock to write covered calls against but many conservative investors find that large market cap blue-chip dividend-paying stocks are a good place to look. Two of the best stocks for covered call writing in todays market. Boeing stock is a great security because not only does it deal in defense which is always.

Selling a 35 call for 150contract in premium on a stock trading at 36. From Novice To Expert These Are The Brokers For You. Exercise style is European.

Best Covered Calls. If you look at just the January monthly expiration then there are about 52M. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because that money is no longer owned or controlled by the company.

For example lets say that the XYZ Zipper Company paid a 050share dividend on June 1. As an example assume an. Find Out What You Need To Know - See for Yourself Now.

1 During periods of market overvaluation where the market is likely to be flat or down for a while. When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade. 1 Selling covered calls for extra income.

Lets get started today. If shares trade at 23 and you sell a 3 month call with a 25 strike for 075 you still make 275 on a 23 stock when you are. Covered Call Covered Calls Options Trading.

1 on 1 Training Offered For Quick and Easy Understanding. Look at UBER for example you can buy the 012122 42c for 2270. Ad Over one million people trust FTX to buy sell cryptocurrencies.

But you should be aware that dividends do play a role in call option pricing. The best times to sell covered calls are. So how does selling covered calls work.

It is always good to. Pick Your Price Target. My favorite equities for selling covered calls on are the SPY SPDR SP500 ETF and large quality companies such as Apple and Google.

2 For slow growth companies so you can maximize your returns from a combination of dividends. 12 rows Company Symbol. The market timer can stand a drumbeat of small 5 to 10.

Lets get into my approach on how I set up a covered call on a dividend paying stock. How Does Selling Covered Calls Work. Ad Learn To Spot Ideal Times To Place Covered Calls For Consistent Income.

Ad Our Top Picks For Online Brokers. The Best Covered Call Stock. There are about 14x more monthly call option contracts outstanding than weekly call option contracts this is down from 35x a few years ago when we last looked at this.

The key is to remember to buy high-quality equities or ETFs. Profit is limited to strike price of the short call option minus the purchase price of the underlying security plus the premium received. Lorillard LO is a tobacco company with a nearly 16 billion dollar market cap that has consistently raised its dividend by.

If you want to write covered calls you must follow your criteria and stick to your plan. Well still have made our 53 in cash per contract from this trade. Boeing Co NYSEBA is a strong candidate for selling covered calls.

Covered call writing is a game of regular incremental returns. If shares trade at 23 and you sell a 3 month call with a 25 strike for 075 you still make 275 on a 23 stock when you are.

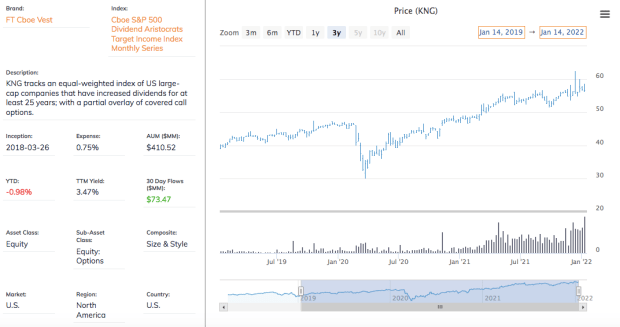

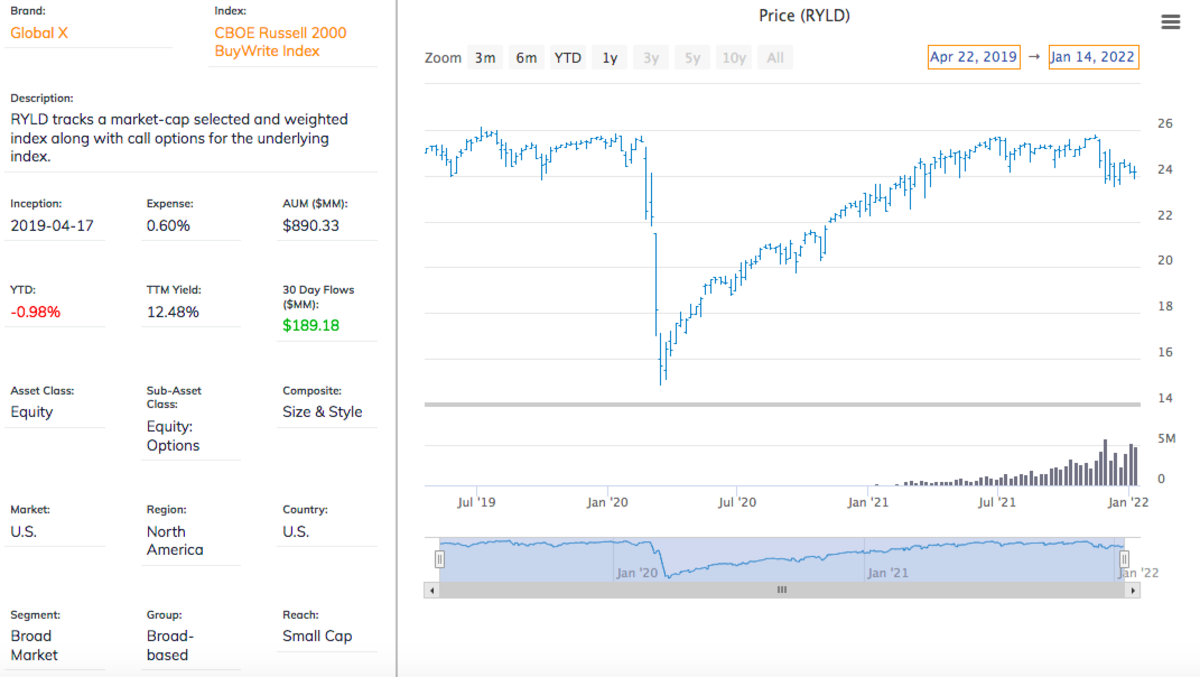

Top 7 High Yield Covered Call Etfs For 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

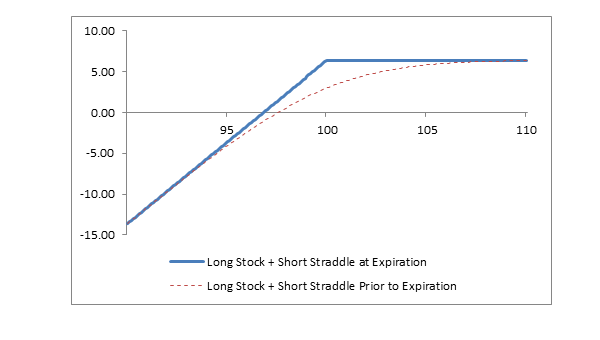

What Is A Covered Straddle Fidelity

Call Option Understand How Buying Selling Call Options Works

Wedding Budget Worksheet Free Download Excel And Google Sheets Options Trading Strategies Call Option Trading Charts

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Top 7 High Yield Covered Call Etfs For 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

The Poor Man S Covered Call What It Is Why I Don T Use It By Erik Bassett Medium

The Poor Man S Covered Call What It Is Why I Don T Use It By Erik Bassett Medium

Covered Call Strategies Covered Call Options The Options Playbook

7 Best Options Trading Examples 2022 Benzinga

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

Covered Calls Basics Risks Advantages Overview

Covered Call Definition Practical Example And Scenarios

Top 7 High Yield Covered Call Etfs For 2022 Etf Focus On Thestreet Etf Research And Trade Ideas

7 Best Options Trading Examples 2022 Benzinga

Covered Call Strategies Covered Call Options The Options Playbook

Best Brokerages For Options Trading In Canada 2022 Wallet Bliss

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)